So whether you just started paying back your student loans or have been paying for a while, do you really want to take 10 years to pay them off?

Imagine cutting off not months but years when it comes to paying down your loans.

This is exactly what I did and I want to show you how you can too.

I cut down my loan-paying time from 120 months to 37 months.

It took a little sacrifice and lots of determination but I got it done.

And so can you.

So how did I do it?

First, let me give you some history.

Disclosure: I am not a financial planner or advisor. I just know what worked for me and want to share the tools I used. If you have questions about financial planning, please seek advice from a licensed financial planner/advisor.

Disclosure: Some of the links below are affiliate links that I have provided for your convenience. Click here to read my full disclosure policy.

Starting Out

My student loan payment consisted of 7 different loans with different balances and different interest rates.

This made my total monthly payment $575 for the next ten years.

This was a large chunk of money as far as I was concerned.

I knew that I did not want to keep paying that for the next 10 years.

I was lucky that I landed a job just after graduation and that my only other debt was my mortgage.

So how can this post help you if you have:

- other debts like credit card debt

- a higher payment amount than mine

- no job?

Well, let me start with #3: Obviously, you need some sort of income.

I suggest working on getting that and then coming back to this post.

As for #1, I suggest paying off your credit cards immediately before trying to quickly pay off your student loans.

Interest rates on credit cards are usually much higher than those on student loans so I suggest paying those off quickly.

The good news is that you can use the same methods I have laid out here to pay off your credit card debt.

Then, after they are paid off, use this same method on your student loans.

If you find yourself with a higher payment amount, then it may just take a little longer but you can still pay it off quickly.

If you suffer from all three situations, follow my advice for #3.

There is just no way around it.

First Things First

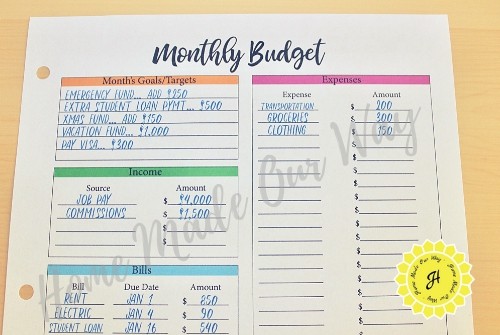

The first thing you would need to do is to gather all your finances, sit down (with your spouse, if married), and create a monthly budget.

Your budget should include your current loan payment amount.

Look at your expenses and find ways to cut them down or eliminate them, at least until you are finished with your student loan.

This is the sacrifice part.

Some suggestions include:

- do your own manicure

- use coupons and shop sales

- change the oil in your car yourself

- eat at home

- consider ‘stay’-cations

Setting Goals for Your Student Loans

Once you have created this budget, estimate your monthly income and subtract all your bills and expenses from it.

This difference will be the ‘extra‘ amount you need to pay towards your loan not including your regular monthly payment.

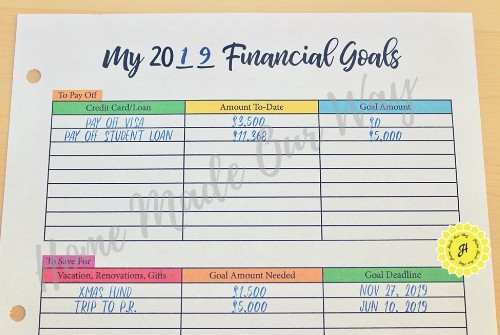

But before you pay anything, you need to create your goal.

Next, pick a day of the week that you will make payments towards your loan.

Yep, you read that right.

You are going to make weekly payments.

For me, I chose Mondays.

Now, when you have this day picked out, count how many of these days are present in the current month.

For example, some months have 4 Mondays and others have 5.

Now, take that monthly difference you found earlier and divide it by the number of days you picked for that month.

So, if your difference is $300 and there are 5 Mondays this month, then you would pay $60 every Monday for that month.

Now, if you have a planner, go ahead and schedule these payments on the day of your choice so you don’t forget.

Multiple Student Loans

Most student loans come from more than one source.

As I said earlier, I had 7 different loans.

If this is the case for you, find the loan with the highest interest rate, and then from those loans find the one with the highest balance.

This will be the loan you will ‘attack’ first.

Every week, continue to pay this loan down.

Naturally, this loan will be the longest to pay.

It took me 14 months to pay my first loan.

By the way, once that first loan is paid, your monthly regular payment will decrease giving you more money to put toward the second loan.

For example, when I paid off that first loan, my monthly payment went from $575 to $420.

This meant that I had an extra $155 I could put towards paying that 2nd loan.

When you do this for every loan paid, you will see those loans start to disappear more quickly.

I promise.

Tips, Tools, and Resources

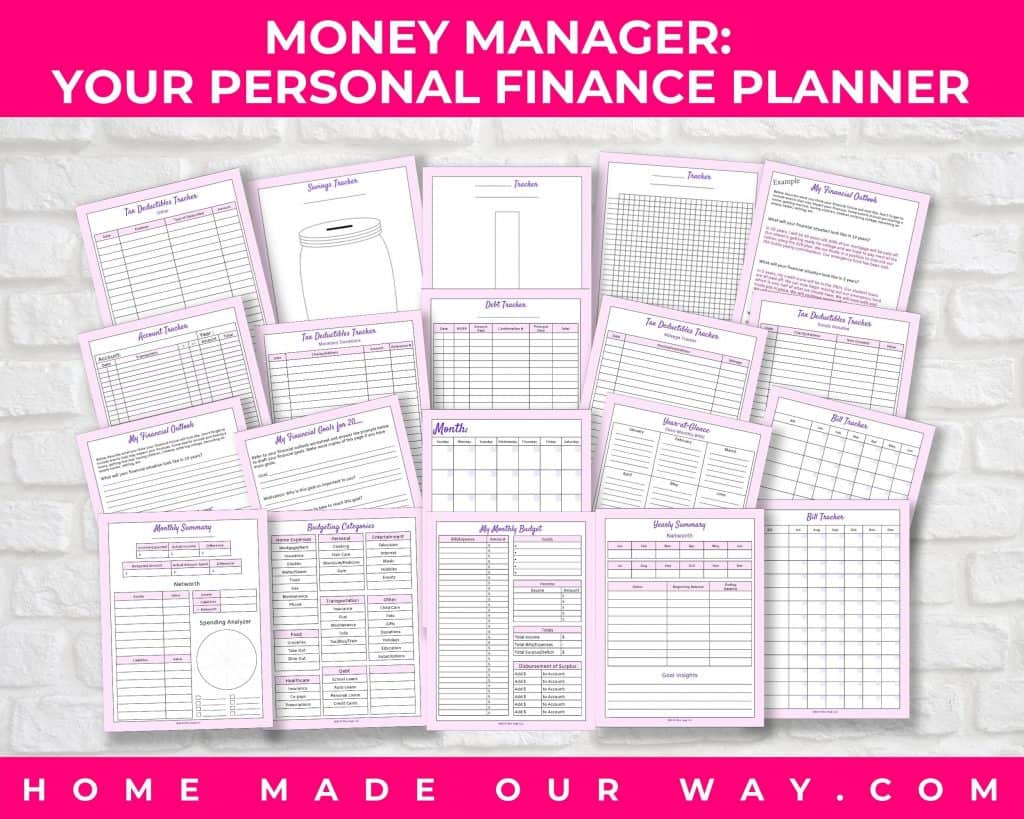

I cannot stress this enough, but start keeping track of your money!

I know that some of you may be horrible at budgeting but this is your money we are talking about here.

Try to get into the habit of watching every penny and stick with a budget.

If you don’t have a budget book/binder, you can get our free financial planner.

Just fill out the form at the end of this post to get your copy.

Now, I’m old school and prefer doing my budget by hand but if you rather use an electronic budget, Mint is a great website/app that can help you with this.

If you are still on the fence about paying off your loan(s) quickly, here are the latest statistics about student loans that will help encourage you to take action.

Well, I hope you find this post helpful as you try to pay off your student loan.

Want to pay off your mortgage quickly too? Read: How and Why You Should Pay Off Your Mortgage Quickly

Leave a Reply