How to Tame and Sort Your Papers and Documents

Whether you have a filing cabinet bursting at the seams with papers or keeping them tucked away neatly, you should have a system for organizing paperwork in place.

Not only will it look nicer but it can help you locate papers quickly when you need them in a hurry.

So, let’s see if we can get our papers sorted and put a system in place that makes sense for you.

Disclosure: This post contains some affiliate links for your convenience (which means if you make a purchase after clicking a link I will earn a small commission but it won’t cost you a penny more)! Click here to read my full disclosure policy.

Before You Begin Gathering All Your Documents

Types of Paperwork

There are tons of types of paperwork that can use some organizing.

Below I have made a list of the more common ones. Please let me know if I missed anything by commenting at the end of this post. I’ll be sure to add it to this list along with solutions for organizing them.

- bills

- banking records

- insurance policies

- investments

- CDs, T-bills, bonds

- vital records: birth certificates and baptismal records

- deeds and titles

- wills

- legal paperwork

- owner’s manuals

- auto records

- contracts

- warranties

- taxes

- medical documents: records, referrals, and histories

- resumes

- schoolwork

- kids’ art

- keepsake letters or cards

- magazine/newspaper clippings

- awards and certificates

- inventory lists

- recipes

Now, before you gather all your paperwork, click here to download our —> paper inventory pdf.

To use it, visit every room or space in your home and write its name followed by the types of papers that are kept there.

For example, in one of the grid’s boxes, I would write the master bedroom, followed by paper keepsakes. Or you can write entryway and mail.

Once you’ve filled out this printable, tackle each section individually. Don’t try to do all of your paperwork at once.

Not only can it take more than one day to organize if you have a lot of documents, but you could end up frustrated and give up entirely.

Sorting Your Documents

With all your papers from one section in front of you, go ahead and sort through them.

Make piles with a specific category in mind. For example, if you have more than one vehicle, create a pile for all your autos first, then segment this further by creating a pile for each specific vehicle.

Decluttering Your Piles

Researching for Online Documents

Once you have your papers sorted, go through them and see if you can find these same documents online.

That is, if you have an online account, see if there is a copy of the same documents you have in front of you. If so, then shred these documents.

For example, USAA keeps a copy of my auto insurance policy online. I also have this bill set up to auto-pay.

So there is no need to keep the actual policy or bill. The only thing I need to print is our auto insurance card when the policy is renewed.

If you are still unsure about shredding a particular document check below and see if it is on the list of “forever documents.”

Forever Documents

Documents you should absolutely keep forever:

- vital records: birth certificates, marriage certificates, death certificates, baptismal certificates

- investment certificates: savings bonds, stock certificates (until redeemed)

- deeds and titles (until sale)

- wills, power-of-attorney, medical directives, and other after-death instructions such as burial preferences (until next update)

- legal papers: settlements, divorce papers

- diplomas, awards, and certificates

You should keep these documents in a fireproof safe or you can purchase a safety deposit box from a bank and keep them there.

You will notice that some of the paperwork above states an “until action“.

That is, you should keep these documents forever up until the action stated.

So, if you update your will, keep the new version and shred the older one.

Taxes

Tax documents can vary.

If you want to know how long you need to keep your taxes and forms, click here to read the IRS guidelines.

Personally, I keep receipts, invoices, and tax documents like W-2s and 1099’s for 3 years after filing my return.

However, I keep my actual return for 7 years.

If you need more help organizing these documents, click here to read my Organizing Tax Documents post.

Medical Documents

Medical records should be secured at a medical facility but if you happen to have a copy, keep these for as long as you think you may need to.

So, if you have an ongoing condition, you’ll want to hang onto them for a while.

Most referrals cover only a certain period of time and usually have an expiration date for any services.

Keep these until every bill that occurs during that time period is paid.

This may mean keeping the referral for some time after the expiration date. But once all services have been paid, go ahead and shred them.

Explanation of benefits that show a payment you have made such as a co-payment or deductible should be kept with your taxes, as these could be deducted.

If you’ve made no payments but it shows payments made to medical/dental facilities, then keep them until all services for that time period have been paid.

Documents that Expire

You can shred any documents that have a set expiration date such as warranties and contracts.

If a document has a “lifetime warranty” written on it, check to see if they are covering your lifetime or the lifetime of the product.

Many companies have a set time period that is considered the “lifetime” of the product.

So while you believe your refrigerator is covered for at least 100 years, it may, in fact, be covered for 20 years.

Banking/Investment Records

If you receive monthly statements from your banks, keep the statement until the new one arrives.

Check that everything looks correct on the new statement.

Your starting balance on the new statement should match the ending balance on the old one. If it’s right, then shred the old one.

You can also scan these documents, which I will go over later.

Bills & Invoices

If you have bills that can be set up as paperless, do so.

However, not all companies have this convenience.

If you receive a monthly paper bill, keeping the invoice is up to you.

Personally, I keep my invoice for a month because I usually keep my payment information on it.

For example, I always write the check number or confirmation/reference number, amount paid, and date of payment on the invoice.

That way, if I receive a bill stating that it was not paid, I have the information ready when disputing the charge.

When the next month’s bill shows that my last balance was paid, then I can go ahead and shred it.

Storing and Filing Paper Records

For all of the above documents, consider organizing them in file folders and then storing these in either a banker’s box, crate, or file cabinet.

However, if you have a huge amount of paperwork for one particular category, consider using an appropriate-sized binder.

This will keep these papers more organized than a simple file folder.

If you have no room for a file cabinet, check out our pegboard DIY for hanging files <— by clicking here.

Keep items you need handy close by like an office file cabinet or crate.

Owner’s Manuals

Most products today keep a copy of their owner’s manual online.

Again, check to see if this is the case.

If so, toss the manual. If you have to keep a few manuals, store these in a binder or bin, label them, and put them away in a storage room.

Auto Records

If you prefer saving all your auto maintenance and repair records for your vehicle(s), purchase a binder to store them.

You can even separate the invoices within the binder using index dividers. Here are some suggested categories: oil changes, scheduled maintenance, recall repairs, and unscheduled repairs.

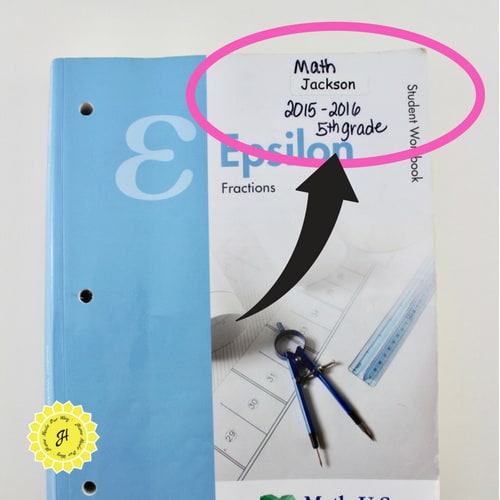

If You Homeschool

If you homeschool, you will have to research your state’s requirements for proof of your child’s or children’s learning progress.

This could be tests, workbooks, reading logs, and even artwork. You should also find out how long you may need to keep them.

If you use an evaluator for your child’s learning progress, ask them what they will require.

The best way to organize your child’s work is to keep them in labeled file folders.

Label them with the child’s name, grade and/or school year, and subject.

If your child does all their work in a workbook, keep these intact. Label the front cover with the same information you would use for file folders.

At the end of the school year, file and store everything in a labeled banker’s box.

Then keep these for as long as your state requires. It may mean keeping them until they are done with high school.

Keepsakes

Many of us just can’t part with certain papers, whether it is your child’s first artwork or letters from loved ones. So yes, keep them but let’s see if we can store them nicely.

You can keep letters and cards in a decorative box like mine pictured below.

Consider framing kids’ artwork. Not only do you get to keep them but you and others can enjoy them daily instead of having them sit in a box forgotten.

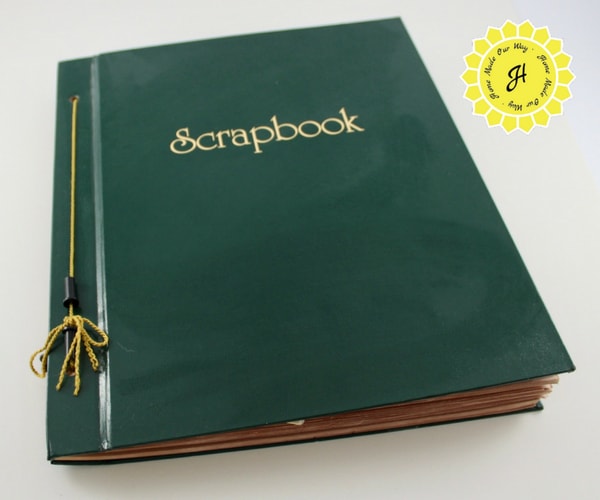

Scrapbooking

You can also store your keepsake documents in a simple scrapbook. I purchased my scrapbook years ago and keep items like newspaper clippings, cards, and other mementos.

And don’t worry, if you are not a crafty scrapbooker. I am not.

I simply tape things in it with no sense of order except chronologically. And that’s because I just tape things in as soon as I get them.

Dealing with Mail

As soon as I get mail, I quickly go through it and deal with it immediately so that in a few minutes it will look as if I never received any mail.

I never let it leave my hands until I’ve sorted out what needs to be done. So whatever you do, don’t just place it somewhere “for now”. This is how it piles up over time.

So the first thing I do is trash any junk mail.

If there is mail for a specific person, I will distribute it.

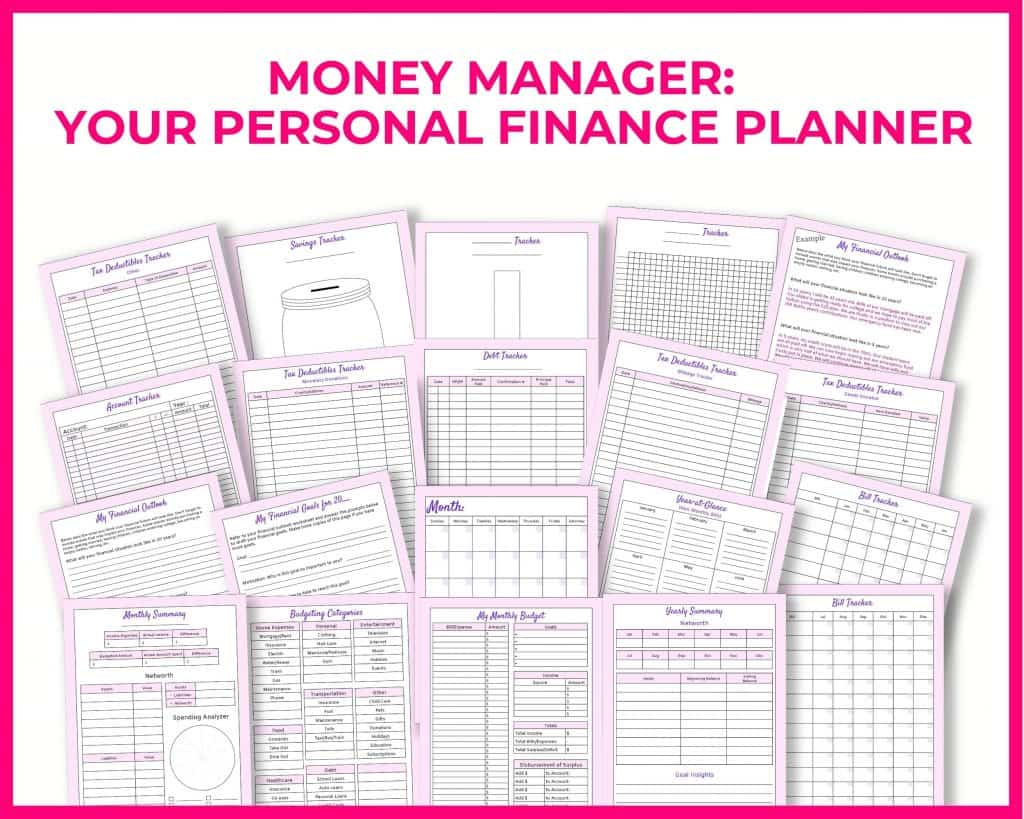

If I receive a bill, I quickly document it in my financial planner and then file it away until it is time to pay it.

Any other mail that comes in and needs my attention, I deal with it right there.

That is, if I need to make a call or fill something out, I just get it done.

It doesn’t take long and evidence of mail is almost non-existent.

Try this for a few weeks. Time yourself to see how long it takes you to deal with your mail.

You’ll be surprised how little time it will take you especially if you are set up for paperless billing with most of your vendors/services.

You can also decrease the amount of junk mail you get by contacting the sender and asking them to be removed from their list.

Don’t want to call a bunch of places? Try these sites that will help you reduce that junk mail:

- CatalogChoice–great for cutting down on catalogs

- OptoutPrescreen–great for reducing credit card offers

- DMAchoice–great mail manager with a $2 fee every 10 years

Going Digital

To help reduce your paperwork, consider going digital.

This includes resumes, inventory lists, and even recipes.

With free options like Google Docs and Sheets, there is no excuse for keeping paper copies.

Simply create your document and save it to your Google Drive.

If you have paperwork already and just want to save it, scan it (if you have one available with your printer) and file it in a desktop folder.

I suggest purchasing a flash drive or an external hard drive and saving your scans on this so that you don’t use too much of your drive or computer’s memory.

You can also purchase a lightweight scanner to scan and upload your documents to your computer faster.

However, another option is to use a scanning app that allows you to take photos of your documents with your Smartphone.

The following are apps to try:

- Google Drive — free

- Genius Scan

- Scannable

Final Thoughts on Organizing Your Papers

When it comes to organizing your documents, remember:

- Inventory and sort your paperwork first

- Do one room/section at a time

- Protect your ‘forever’ documents

- Keep only what you need at the time and shred the rest

- Deal with paperwork right away

- Go digital

- Choose storage solutions that best fit your types of paper

And with that, let’s get started on organizing your paperwork and documents.

The sooner the better because it may take a few days, maybe a week or two, to get through everything. But once done, you will notice a difference.

Other Articles Related to Organizing Papers

Need help with other types of “papers”? Below are links to related posts that can help you get them sorted out.

Keep your tax records for 3 years. This includes your receipts & invoices if you are self employed. You can be audited up to 3 years past the due date of the return or the date filed. You need to be able to verify the #s on your tax return. There is plenty of info available at irs.gov

Hi Penny,

Thank you for catching that. I updated the information.